Tariffs. Duties. Regulatory up‑and‑downs. For anyone in the world of logistics, it’s like juggling flaming torches, exciting but nerve‑wracking. In this post, we’re taking a breezy stroll through how these tariff shifts are rippling across global trade and logistics operations, raising cross‑border shipping costs, fueling freight insurance headaches, and generally stirring up price increases. But don’t worry, in the midst of the cash flow under trade pressure, there’s a little lifeline called invoice factoring that may just be the cost‑saving friend you didn’t know you needed.

When Tariffs Meet Trucks, Ships, and Supply Chains

Tariffs, which are essentially import taxes on goods coming into the country, are meant to protect local industry or boost revenue. In practice, they often push up prices and slow customs processing.

The U.S. average effective tariff rate recently surged to around 18.6 %, the highest level since 1933, according to APNews. Analyses published by Reuters estimate rates as high as 20.1 % or even 22.5 %, marking a century-high peak.

That jump isn’t harmless; import prices have generally risen, cutting into cost savings across global supply chains.

In cross-border trucking, fleets in Canada are reporting new truck costs up by about 9 %, or $35,000 more each, a real hit to budgets. At border crossings like the World Trade Bridge, wait times now stretch over an hour. (Source: industry reports and logistics anecdotes—widely observed in trade press.)

Meanwhile, high-value goods such as luxury items, electronics, and products with strict origin requirements are facing increased scrutiny. The long-standing duty-free allowance known as the de minimis exemption has also changed. For packages under $800 from China or Hong Kong, the exemption has been removed, leading to unexpected customs duty charges and shipping delays, according to Redwood.

Short-Term Chaos: Front-Loading and Shipping Finance Volatility

When news of tariffs drops, logistics teams go into full sprint mode, front-loading shipments before rates increase. For instance, according to the San Francisco Chronicle, imports at the Port of Oakland spiked 31 % in July as companies rushed to beat the new thresholds.

Wired reported that one Bitcoin firm reportedly chartered a Boeing 777 to airfreight $1.3 million in gear ahead of tariffs—overnight freight costs skyrocketed up to 10×. Front-loading often leads to booking chaos and freight rate inflation.

Paradoxically, in some markets, container spot rates have collapsed, down around 58 % on the West Coast and 46 % on the East, as global routing, supply, and trade uncertainty battered spot price stability, according to Reuters.

Long-Term Ripples in Global Supply Chains

Over time, tariffs are prompting strategic shifts in sourcing and routing. Many companies are turning from China toward Southeast Asia or opting for near-shoring to Mexico or Canada. It’s a smart long-term play, but it comes with new customs clearance learning curves and customs duty delays.

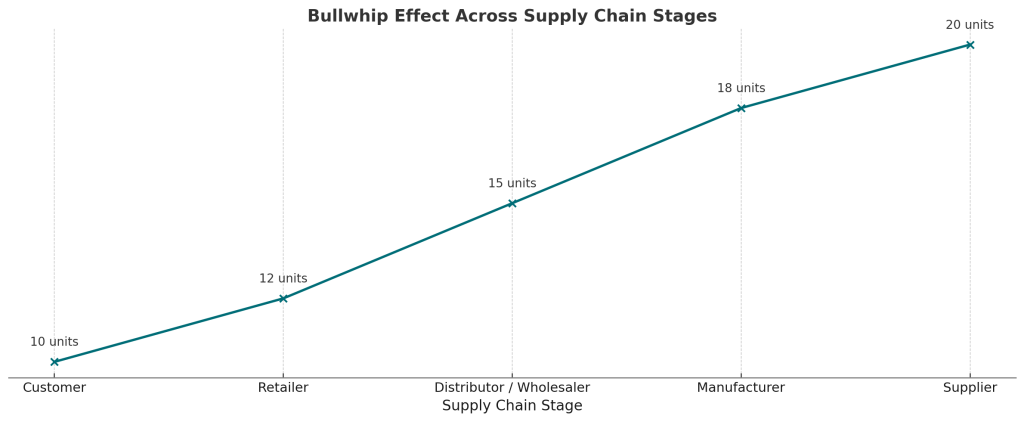

This is the “bullwhip effect,” small ripples in tariff policy turning into big waves in shipping behavior and logistics operations. Companies may add infrastructure or adjust operations, but logistics companies still face ongoing volatility.

On a brighter note, some carriers are showing resilience. A.P. Moller–Maersk recently raised its full-year 2025 profit forecast—revenue grew 3 %, EBITDA rose 7 %, and expected global container volume growth now stands between 2–4 % (Source Reuters). That said, freight finance solutions are still under pressure, with rates down roughly 9 %, so margin management remains key.

Cash Flow Under Trade Pressure: How Invoice Factoring Can Help

Tariffs, duties, and clearance delays can leave you juggling high freight volumes with low cash on hand. You’ve still got to pay fuel, payroll, freight insurance, customs clearance fees, and perhaps late clearance penalties.

Scale Funding can help counter cash flow issues with invoice factoring. Instead of waiting 30, 60, or even 90 days for payments, you can convert unpaid invoices into near-instant cash. It’s a non-debt way to keep shipping and logistics cash gaps patched and operations rolling.

Because it scales with your volume, it’s a flexible freight finance solution, critical when shipping finance volatility hits or when you’re covering unexpected full truckload rates.

Tariffs, Duties, and Regulatory Volatility in Logistics

This infographic shows how tariffs and customs duties affect logistics costs, shipping timelines, and global supply chains. It also highlights how invoice factoring with Scale Funding helps cover customs fees and maintain cash flow when trade pressures rise.

Final Word, Keep It Bright, Keep It Moving, with Scale Funding

Tariffs and duties are part of global trade now, but they shouldn’t stall your business. Sure, they strain cash flow, disrupt customs processing, hike cross-border shipping costs, and inject uncertainty into global supply chains. But they also underscore the value of having smart tools: strong customs clearance strategies, good freight insurance, and flexible freight finance options.

That’s where Scale Funding comes in. We know the pinch of sudden tariffs impacting your freight, the headache of customs duty delays, and the pinch when clearance fee customs stack up on your balance sheet.

With Scale Funding’s invoice factoring, you can:

- Cover full truckload rates without missing a beat

- Maintain freight insurance and clearance payments on time

- Smooth unexpected cash disruptions tied to tariff volatility

We’re fast, straightforward, and just the steady cash flow partner you need when trade pressures tighten.

RESOURCE CENTER

Learn More About Business

Top 10 Trucking Technologies for 2025 | Tools for Fleet Growth

It is a night-and-day difference driving a semi today compared to 20 years ago. Before major technological advancements, truck driving…

5 Changes to Expect in Trucking in 2026

As we begin turning to the year 2026, we reflect on the vital role trucking plays in strengthening the nation’s…

Haul-o-ween: How the Treats Get to Your Door Before the Kids Do

Every fall, the country fills up with pumpkins, costumes, and candy. Kids pick out their favorite characters, parents stock up…