Accounts Receivable Financing, also known as invoice factoring, helps businesses unlock working capital by turning unpaid invoices into immediate cash. Instead of waiting 30, 60, or even 90 days for customer payments, you can access funds within 24–48 hours, improving liquidity and keeping operations moving.

What is Accounts Receivable Financing?

A/R Financing is an alternative funding solution where a business sells its open invoices to a factoring company. In exchange, the company receives a cash advance, minus a small fee. This allows you to maintain steady cash flow without taking on additional debt.

Key benefits:

- Converts unpaid invoices into cash fast

- Improves cash flow and liquidity

- Avoids adding debt to the balance sheet

Who Uses Accounts Receivable Financing?

Many industries rely on factoring to stabilize cash flow and support growth. Typical users include:

- Small and Medium-sized Companies

- Startups

- Staffing Agencies

- Seasonal Businesses

- Manufacturers

- Oilfield Service Providers

- Wholesalers and Distributors

8. Telecom & Wireless Services

9. Construction Companies

10. Healthcare Providers

11. Importers and Exporters

12. Transportation and Logistics Companies

These businesses use receivable financing to meet payroll, cover expenses, and fund expansion, without waiting on delayed customer payments.

Why Use Accounts Receivable Financing?

Businesses choose A/R financing when they face extended payment terms or uneven cash flow. It’s a flexible and fast solution for:

- Quick Access to Capital: Receive funds in 24–48 hours.

- No Debt Added: Sell invoices instead of borrowing money.

- Easier Qualification: Ideal for companies that may not qualify for traditional bank loans due to limited credit or collateral.

- Control Over Cash Flow: Choose which invoices to factor based on your needs.

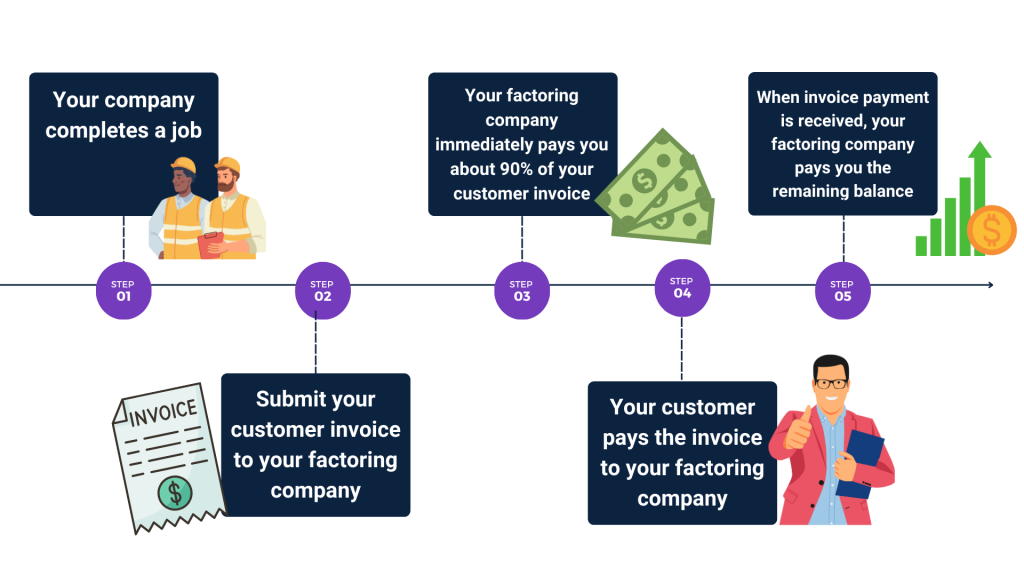

How Accounts Receivable Financing Works

- Submit invoices to a factoring company.

- Receive a cash advance (typically 80–90% of invoice value).

- Customer pays the invoice to the factoring company.

- You receive the remaining balance, minus a small fee.

This simple process helps you maintain predictable cash flow and focus on growth.

How It Promotes Business Growth

Accounts receivable financing is more than a short-term fix — it’s a strategic tool for long-term growth.

Benefits include:

- Increased Liquidity: Access working capital to invest in expansion, marketing, and hiring.

- Better Financial Planning: Predictable cash flow supports smarter decisions.

- Operational Efficiency: Reduce time spent managing collections.

- Stronger Supplier Relationships: Pay suppliers on time and earn discounts.

With steady cash flow, you can seize opportunities and scale your business confidently.

Partner With Scale Funding

At Scale Funding, we help businesses move beyond traditional banking with financing solutions that keep you growing. Our accounts receivable financing program offers flexibility, transparency, and speed, empowering you to stay ahead of cash flow challenges.

Get in touch today to learn how Scale Funding can help you convert invoices into opportunity.

Learn if accounts receivable financing is right for you!

RESOURCE CENTER

Learn More About Business

Staffing Industry Trends – February 2026

Insights on trends, market dynamics, and industry innovations

How Much Does Invoice Factoring Cost? Breaking Down Fees & Rates

Invoice factoring is a fast, flexible way for businesses to unlock working capital tied up in unpaid invoices. For industries…

How Staffing Firms Win More Business in a Tough Hiring Market

According to the Entrepreneur Magazine article “Job-Seekers Find the Market Challenging to Break Through – And It’s Due to One…