On December 15th, VP of Business Development, Sheri Tischer, combined her 15 years of staffing experience with VP of Business Development Dan Eichstaedt’s 17 years of sales and finance experience to discuss “How to Recession Proof your Staffing Agency in 2023.” This webinar touched on topics such as:

- Client Diversification for risk mitigation and growth

- Developing and cross-training your team – it’s a win-win

- Growing the Business and Improving Cash Flow

- Know your Options for Cash in an uncertain economy

- Understanding the Benefits of Receivables Financing

Watch the full webinar here:

Use the slides below to follow along with the presentation:

[su_image_carousel source=”media: 95479,95480,95481,95482,95483,95484,95485,95486,95487,95488,95489,95490,95491,95492″ crop=”none” max_width=”500px” autoplay=”0″ image_size=”full”]

Diversification

It’s one of the top challenges we see staffing agencies deal with, and lack of diversification can be devastating to a business. While this might be a bigger area of concern for a start up or small agency, all agencies regardless of size or time in business should be managing their diversification. It’s important to consider both your total # of billing clients along with the concentration of each client.

Forbes suggests that in a mature business, no single client should account for more than 10% of total sales; we’ve seen other sources suggest 20%. Bottom line, you don’t want all your eggs in one basket.

Why Diversify?

Diversification is important as it protects your business from the loss of a large client or an industry downturn. Just as important, it protects from a client that is slow paying or non-paying.

5 Tips on How to Diversify:

- Analyze your existing portfolio.

- Create a diversification plan.

- Consider adding new solutions, such as creating a Direct Hire program with a dedicated team.

- Set aside time each week for new business development.

- Consult with a staffing industry expert for diversification strategies to promote growth.

Develop and Cross-Train your Team

- Product Knowledge and Direct Job Skills

- Beyond Product Knowledge and professional development

- Cross-Training

- Upskilling and Developing Contractors

Training is viewed as filling a gap and teaching a person how to do their job.

Professional development is viewed as focusing on the future and growth of your staffing agency and the future and growth of your employee.

[su_note note_color=”#495e72″ text_color=”#ffffff”]Dr. Laurie Bassi, a Human Capitalist Specialist, found a 21% increase in productivity, profit margins were 24% higher, and a 300% reduction in employee turnover after focusing on cross-training and developing your team.[/su_note]

[su_pullquote align=”right”]Top Training Topics for 2023: Conflict Resolution • Teamwork • Time Management • Stress Management • Emotional Intelligence and StrengthsFinder • Negotiation Training • Leadership Training [/su_pullquote]

Benefits to Team Development and Cross-Training

- Great Return on Investment

- Increases efficiency

- Better teamwork and collaboration

- It’s what they are asking for!

- Increases motivation

- Workforce Sustainability – Employee well-being and overall retention

- Makes your company more agile

[su_note note_color=”#495e72″ text_color=”#ffffff”]The talent management platform Clear Company found that 94% of employees would stay longer if a company invested in staff development.[/su_note]

Growing the Business and Improving Cash Flow

6 Tips for Improving Cash Flow and Growing the Business

- Contract Payment Terms: To improve your cash flow, asking yourself the right questions about your contract payment terms is important. Are you doing a standard payment term with everyone? What if they pay late? Are those payment terms working for you? When you ask yourself questions like these, you’ll be able to narrow down which contract payment terms benefit you versus hurting your cash flow.

- Work your Aging: There are four key things to focus on when you work your aging. First of all, designate someone to be responsible. No one wants to do this, so designating one person to be in charge will eliminate the chances of it being passed over as a duty. The next step is to make sure it is done consistently. If you don’t consistently work your aging, it’s easy to brush it aside repeatedly until it’s no longer being done. Another key focus is treating your clients’ AP department like your treat your HR contact or hiring manager.

- Adjust your Pricing Model: A standard rate increase program for your clients is one option. Another is to use labor market data analytics to support your need for higher bill rates with certain positions. Using a product like Talent Neuron or Emsi gives data around difficulty to fill and will support your ask of a higher bill rate.

- Focus on Filling the “right” Orders: An order isn’t an order until it’s filled, billed, and collected! With that in mind, not only is it important to accept good, fillable orders but you need to make sure that your client can pay. Having a process in place to check credit and establish credit limits is just as important as making sure the job is fillable.

- Expand your Business: Is now the time to expand to new geographies, add to your list of skill sets, or look at adding a new solution such as a direct hire program, msp solution, or onsite program?

- Pursue Financing: If you plan to expand your business, it’s important to make sure you’ve got the cash flow to support that growth. Cash flow is having the right amount of cash in the right places at the right time, every time. – Adam Stewart, Debt Collection Expert

[su_note note_color=”#495e72″ text_color=”#ffffff”]According to the research done by U.S. Bank and cited on the SCORE and Counselors to America’s Small Business, cash flow is the reason 82% of small businesses fail.[/su_note]

Know your Options for Cash in an Uncertain Economy

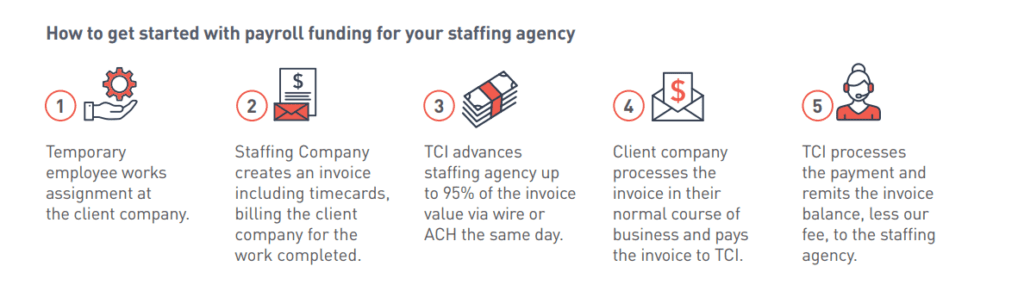

There are a variety of cash flow solutions for staffing agencies. Self-funding is self-explanatory. This is the least costly of all cash flow solutions, but it is a high-stress solution. No one likes to spend their own money. Another option is a bank line of credit or a loan. There are some benefits, such as funds on-demand, a safety blanket approach, and fees only occur if they are drawn upon. However, setup time, time in business, ratios, & oversight are all downsides that come hand-in-hand with a bank line of credit or loan. Merchant cash advance loans are quick and easy to obtain, but they implement very high fees while being an unsustainable option. Payroll funding, also known as receivables financing, is fast with flexible terms. With us, you can choose your clients in addition to a month-to-month contract. The only con to payroll funding is our volume minimum.

Understanding the Benefits of Receivables Financing

The biggest challenge staffing agencies face is meeting weekly payroll when it takes 15 days, 30 days, or even 60 days for customer payments. Payroll funding for staffing agencies gives companies access to the working capital they need to meet payroll obligations and grow. Payroll funding is also known as accounts receivable financing; it provides instant cash flow so your agency can grow without limits. The process works by selling your open receivables to a payroll funding company in exchange for an immediate cash advance.

Having a dependable funding source is one of the most essential aspects of operating a successful agency. Payroll funding from Scale Funding gives staffing agencies the confidence that payroll will be met every time. Payroll funding gives you the financial freedom to market your agency, take on new clients, go after large contracts, fill orders, and achieve the goals you have for your agency.

Contact our staffing or sales expert:

Sheri Tischer, VP of Business Development – stischer@tcicapital.com

Dan Eichstaedt, VP of Business Development – dan.eichstaedt@tcicapital.com

RESOURCE CENTER

Learn More About Staffing

Staffing Stats

Contract Staffing Employment Update The staffing industry continues to make gains in what has otherwise been a very tough year…

Staffing Industry Trends – December 2025

Insights on trends, market dynamics, and industry innovations

Why Great AI prompts Matter, and How Staffing Teams Should Use Them

The staffing and recruiting world has never moved faster. Between skills‑gaps, low labor participation, a demographic drought, and clients demanding…