Alternative energy is a modern-day buzzword. Developers want it, governments fund it and investors are making money off of it. With all this activity and interest, it can be challenging to identify where value is really being created. Where is this nascent technology actually proving itself? Where is it mostly being propped up by government subsidies? While fraught with good intentions, governments don’t always choose the natural winners in their quest to expedite innovation. Here’s a quick rundown of how alternative energy is looking these days.

Investing in Renewable Energy: the Big Players

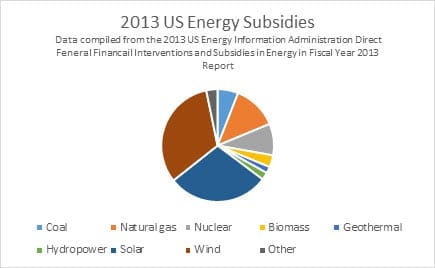

A good place to begin this conversation, which many an anti-subsidy argument tends to leave out, is that traditional methods of providing energy have long been subsidized. A 2011 report from DBL investors outlines the long history of government subsidies to oil, gas and coal. Many subsidies still exist in these industries. Compared to the subsidies that propped up these industries when they were new, the money earmarked for renewable energies is trivial. What isn’t so trivial, however, is that its impact on economic investment cues is negligible, which is why investors should pay close attention.

The major players in terms of renewable energy, and subsequently in terms of federal subsidies, are wind and solar power. Subsidies, however, are not necessarily a sign of success. Nowhere is this more apparent than with the failure of Solyndra. Solyndra was a government-supported solar power start-up based in California. In 2011 it declared bankruptcy, leaving taxpayers with over $500 million of lost money that had been spent in support of the corporation. What followed was a media storm over renewable energy subsidies.

Source: https://www.eia.gov/analysis/requests/subsidy/

The story of Solyndra should serve as a warning call for investors. Just because the government has backed something does not mean it can’t fail. True value, or lack thereof, will ultimately determine who wins and who loses in the alternative energy game. Since 2011, a slew of other government-backed companies have joined the ranks of failed companies.

Choosing Where to Invest in Renewable Energy

Wind & Solar

Wind and solar power are the starlings of many alternative energy enthusiasts. In 2013, the U.S. Government invested $5.936 billion in wind energy and $5.328 billion in solar energy. The Institute of Energy Research helps put this number in perspective. According to the institute, wind power is subsidized at a rate of $23.37 per megawatt. Solar power is subsidized at a rate of $23.34 per megawatt. In contrast, current coal subsidies amount to roughly 44 cents per megawatt. Coal, however, is clearly on its way out. What’s more interesting are the subsidies to other alternative energy sources.

Hydroelectric & Hydrogen

Hydroelectric power is subsidized at only 67 cents per megawatt, and hydrogen power at $1.59 per megawatt. This means that for a hydrogen power plant to successfully compete in the U.S. alternative energy marketplace, it needs to be 14 times as competitive as wind-based power. Hydroelectric power needs to be nearly 35 times as competitive. Despite these numbers, hydroelectric power still makes up six percent of U.S. energy consumption, as opposed to only 4.7 percent and 0.6 percent for wind and solar, respectively. Though hydrogen does make up 20 percent of U.S. energy needs, our hydrogen plants are far from clean. The most recent plant was constructed in 1999, at a time before many innovations in hydrogen energy made the technology more environmentally friendly.

In Europe, hydroelectric power is the second-largest source of renewable energy. Clean, green hydrogen plants are also springing up throughout the world. The ability of hydrogen plants to utilize the excess energy created by solar plants is especially interesting.

Recent Developments

The United States may be taking a page out of Europe’s playbook soon, slashing subsidies to wind and solar in an effort to see whether they can succeed on their own. At the end of 2016, the most significant solar power tax cut expired. This tax break reimbursed solar energy developers 30 percent of their project’s costs. Wind has already undergone a similar transition, losing major subsidies in last years. Wind plants are still operating competitively in some parts of the county, but in other places they are not doing as well. This highlights yet another problem of including government subsidies in a cost-benefits analysis of an industry’s potential profits: subsidies aren’t dependable.

The U.S. Government may be banking on wind and solar energy, but that doesn’t mean that these two industries will define the future of energy in the United States. As noted, hydroplants have a long and successful history in Europe, and a number of countries are making great strides in hydrogen energy production. In short, investors should look past government subsidies when determining the potential success or failure of an industry or company. Governments mean well, but do not always choose the winners. Economically infeasible technologies will eventually be weeded out by their stronger competitors no matter how many subsidies they receive.

About Scale Funding

Scale Funding is an invoice factoring company serving businesses across the United States. For more information on factoring, call (800) 707-4845 for a free, no-obligation consultation and quote.

RESOURCE CENTER

Learn More About Renewable Energy

Cash for Expansion and Growth

Factoring with Scale Funding Delivers the Cash Your Business Needs

Renewable Energy Contractors

Factoring Provides the Cash You Need Today. Factoring for Renewable Energy Contractors Cash for Payroll, Purchasing Equipment, Paying Bills, and…

Invoice Factoring for Renewable Energy Contractors

No matter the industry, businesses need cash on hand to operate. Cash is the fuel that powers business operations. Invoice…