Sheri Tischer, VP of Business Development at Scale Funding, and Jeff Pelliccio, founder of Allied Insight, were live on LinkedIn discussing “How to Recession Proof Your Staffing Business.” If you were unable to tune in, don’t worry! We recorded it.

In this discussion, Sheri and Jeff will cover:

- Diversification

- Upskilling

- AR Management

- Cash Resources

- Financing Options

Why is diversification so important today?

It’s essential to manage your customer concentration. Forbes suggests that no single client should account for more than 10% of your total revenue, although some sources say 20%. In other words, don’t put all your eggs in one basket, just in case that basket breaks. Small or startup agencies can struggle with this as they take on one large client that requires a lot of time, energy, and resources. Additionally, this can put you at risk for credit and accounts receivables issues. Staffing agencies with many clients can also fall into trouble by being too industry-specific. In either situation, losing your significant client or the industry taking a downturn could be devastating.

Tips on diversifying

- Analyze your current business and client volume, industry, DSO, and GP% to come up with a diversification plan to fill in the gaps

- Expand geography

- Add a new product

- Create a target list of prospects in a variety of industries

- Add or adjust skill sets

- Get your sales and recruitment team involved and aligned with your plan

- Consult with an industry expert

Develop and Cross Train your Team

The American Staffing Association recently did a candidate Sentiment Survey, and poor career growth or lack of professional development was one of the top reasons why people left their last job; as a matter of fact, it came in right behind being burned out. Developing and cross-training your team beyond product knowledge is critical for retention and morale. It’s a win-win because it also better positions your employees and your business for success in the event of an economic downturn. Examples of skills that can transfer across industry and positions include time management, leadership, team building, and emotional intelligence training. Book clubs are also a great way to support professional development. Another way to promote career growth is by incorporating micro adjustments and promotions. Micro promotions help incentivize and set milestones for people to aim for. Giving employees ownership of a project feeds them intrinsically, and the return on that is significantly higher than solely monetary compensation.

Exceeding Expectations

Are your relationships solid? How many contacts do you have at each client company? These are good questions to ask yourselves to avoid running into the dilemma of your only point of contact with a client leaving you without a solid relationship to fall back on. A goal of at least five contacts at each client company is a great guideline to ensure the relationship’s longevity. Another critical point is to study the client experience. Learning what the entire client experience is like and what needs to be improved will lead to more success. The client experience should represent the company’s core values and mission statement.

Know your options for cash

Self-funding is the ideal situation. However, researching and knowing your options if you need a solution in the future is setting yourself up for success. Several options exist: bank loans and lines, credit cards and merchant cash advances, and accounts receivable financing. Determine what type of service and qualities you expect from a funding partner. ASA research shows that client companies are looking for their staffing partner to have agility and transparency. Your clients expect you to move quickly, and with open communication, you should ensure your financial partner can do the same.

Tips for AR Management

- It starts with your contract terms. Whether a direct contract with a client or working through an MSP, ensure you have favorable payment terms and the ability to communicate with the client if the invoice is unpaid.

- Monitor client payment trends. If your client typically pays in 30 days and suddenly, they are paying in 35 or 40 days, it’s a red flag.

- Have a dedicated internal resource to manage your receivables.

- Develop a relationship with your client’s accounts payable department. As you make calls on the hiring managers on HR, include the AP department in your rounds.

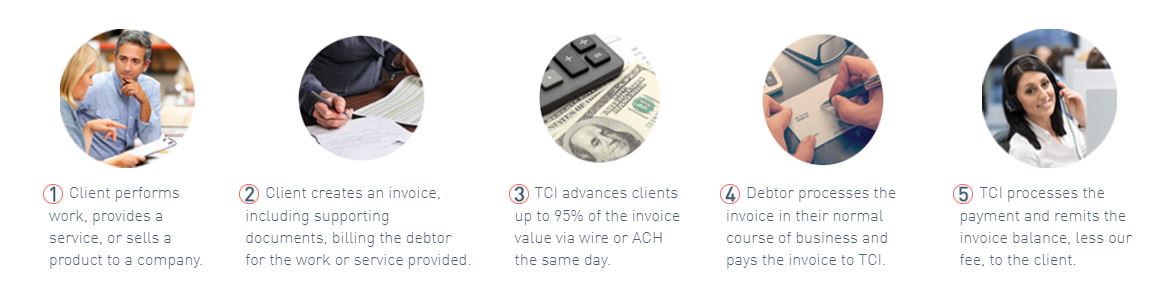

Payroll Funding

The biggest challenge staffing agencies face is meeting weekly payroll when it takes 15 days, 30 days, or even 60 days for customer payments. Payroll funding for staffing agencies gives companies access to the working capital they need to meet payroll obligations and grow. Payroll funding is also known as accounts receivable financing; it provides instant cash flow so your agency can grow without limits. The process works by selling your open receivables to a payroll funding company in exchange for an immediate cash advance.

Payroll Funding Process

RESOURCE CENTER

Learn More About Staffing

Staffing Industry Trends – February 2026

Insights on trends, market dynamics, and industry innovations

How Staffing Firms Win More Business in a Tough Hiring Market

According to the Entrepreneur Magazine article “Job-Seekers Find the Market Challenging to Break Through – And It’s Due to One…

Staffing Firms’ Most Pressing Concerns: Cash Flow, Credit Risk, and Access to Funding

The staffing industry continues to operate in a complex and uncertain economic environment. While concerns like trade policy, labor availability,…