The staffing industry continues to operate in a complex and uncertain economic environment. While concerns like trade policy, labor availability, and inflation dominate broader business surveys, staffing firm leaders are zeroing in on a more immediate and operational reality: cash flow risk.

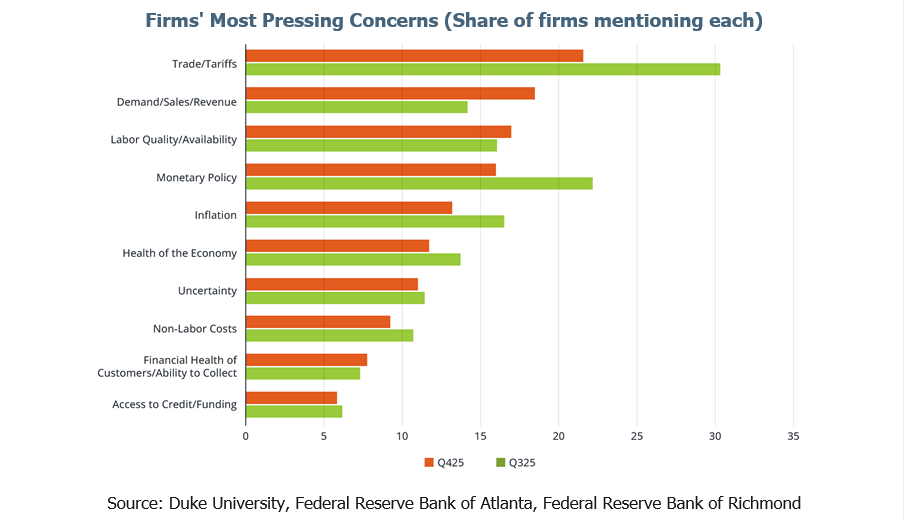

According to the latest Weekly Economic & Business Outlook from the American Staffing Association, CFOs in the staffing industry consistently identify “financial health of customers/ability to collect” and “access to credit or funding” as two of their most pressing concerns. These findings align closely with broader economic research from Duke University and the Federal Reserve Banks of Atlanta and Richmond, which shows financial health of customers and access to funding ranking among the top issues firms are monitoring today.

For staffing firms, these concerns are not theoretical. They show up every payroll cycle.

The Cash Flow Squeeze Facing Staffing Firms

Staffing firms operate on a fundamentally challenging cash flow model. Payroll must be met weekly or biweekly, while client payment terms often stretch 30, 60, or even 90 days. When clients delay payment or experience financial strain themselves, staffing firms are forced to carry the burden.

The data underscores this reality. While issues like demand, labor availability, and overall economic health fluctuate, concerns around customer financial health and collections remain persistent, particularly for businesses that depend on timely receivables to fund ongoing operations. At the same time, access to credit and funding remains a growing concern, especially as traditional lenders tighten underwriting standards and reassess risk.

For CFOs and owners, this combination creates real pressure:

- Meeting payroll without interruption

- Managing unpredictable collections

- Preserving liquidity for growth opportunities

- Avoiding additional debt on the balance sheet

Why Traditional Financing Often Falls Short

Traditional bank financing is not always designed for the staffing industry’s cash conversion cycle. Credit lines can be slow to adjust, restrictive, or tied to financial covenants that limit flexibility. When client payment behavior changes or growth accelerates quickly, staffing firms can find themselves underfunded at the exact moment they need capital the most.

As the economic data shows, access to funding is not just a growth issue, it is a stability issue.

How Scale Funding Helps Staffing Firms Stay Ahead

Scale Funding directly addresses the two top concerns highlighted by staffing industry CFOs by using invoice factoring as a strategic cash-flow solution, not just a short-term fix. When you work with Scale Funding, you receive:

- Immediate Access to Working Capital

Invoice factoring allows staffing firms to unlock cash tied up in outstanding invoices, rather than waiting 30, 60, or 90 days to be paid. Scale Funding purchases approved invoices and advances funds quickly, providing immediate working capital to cover payroll, operating expenses, and growth initiatives. Because funding is tied to receivables rather than long-term debt, staffing firms can scale without increasing leverage or taking on restrictive loan covenants. - Stronger Credit Risk Management

Scale Funding goes beyond funding alone. Client credit checks provide staffing firms with visibility into the financial health of their customers before issues escalate. This proactive approach helps firms make informed decisions about who they work with and on what terms. - Dedicated A/R Support to Accelerate Collections

With dedicated accounts receivable support, Scale Funding helps streamline collections and reduce payment delays. Faster collections improve cash predictability and reduce the operational burden on internal teams.

Confidence in an Uncertain Economic Environment

The broader economic data reinforces what staffing firm leaders already know: uncertainty is not going away anytime soon. Concerns around inflation, monetary policy, and economic health continue to shape decision-making across industries. In this environment, predictable cash flow and reliable access to funding become competitive advantages.

By addressing the financial health of customers and access to funding head-on, Scale Funding helps staffing firms move from reactive cash management to confident financial control.

For CFOs and owners navigating ongoing uncertainty, that confidence can make the difference between simply keeping up and positioning the business for its next phase of growth.

RESOURCE CENTER

Learn More About Staffing

Staffing Industry Trends – February 2026

Insights on trends, market dynamics, and industry innovations

How Staffing Firms Win More Business in a Tough Hiring Market

According to the Entrepreneur Magazine article “Job-Seekers Find the Market Challenging to Break Through – And It’s Due to One…

Staffing Stats

Contract Staffing Employment Trends: January 2026 Labor Market Update Staffing Employment Pulls BackThe American Staffing Association (ASA), Staffing Index declined…