Running a business is challenging. As a business owner, you have employees, customers, and partners depending on you. Keeping up becomes even more difficult as technology advances at a rapid pace. To grow and stay competitive, investing in new technology and automation is no longer optional.

But many business owners ask the same question. How do you invest in technology when your cash is tied up in unpaid invoices?

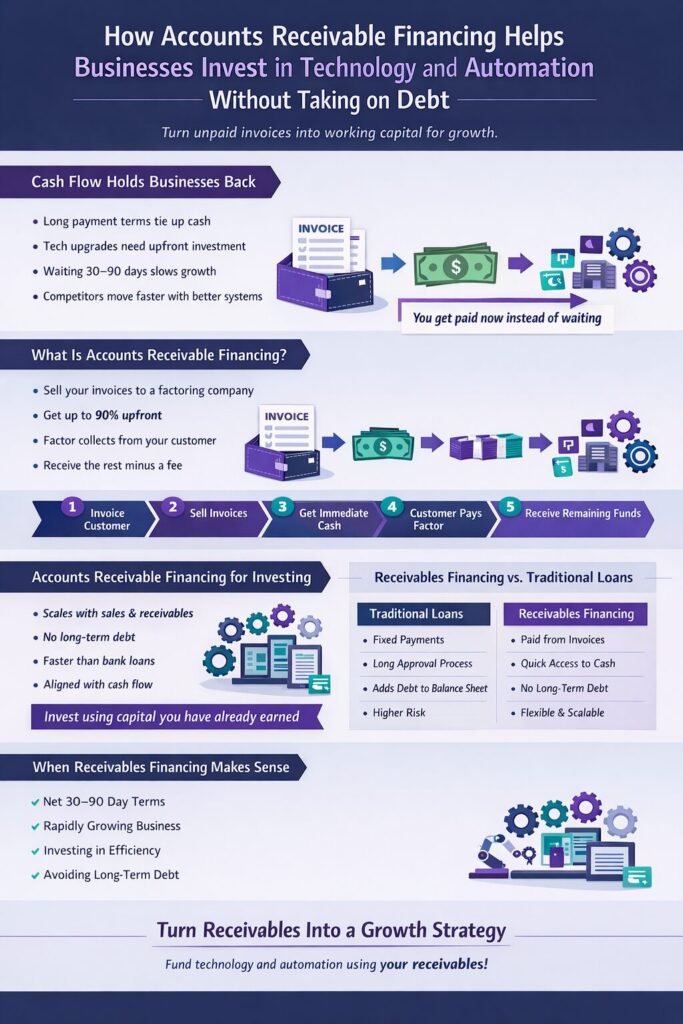

That is where accounts receivable financing comes in. A/R financing frees up cash flow so you can invest in technology and automation without taking on additional debt. In this article, you will learn what accounts receivable financing is, how it reduces the pressure of waiting on customer payments, and how it can support long-term growth.

Why Cash Flow Prevents Technology and Automation Investments

In many B2B industries, such as manufacturing, staffing, medical, technology, and trucking, long payment terms are the norm. Businesses often have strong sales but limited cash on hand, leaving them with stacks of invoices instead of usable capital.

This puts pressure on operations. Companies risk falling behind competitors who are investing in newer systems and automation. Without the right tools, businesses rely on manual processes, outdated systems, and larger teams to keep up.

While technology and automation require upfront investment, the long-term return is clear. Automation improves efficiency, reduces labor strain, and allows employees to focus on higher-value work that drives growth.

What Is Accounts Receivable Financing and How Does It Support Investing

Accounts receivable financing is a straightforward way to access working capital when cash flow is tight. A factoring company purchases your open invoices and advances up to 90 percent of their value, minus a small fee. When your customer pays, you receive the remaining balance.

This allows you to turn unpaid invoices into immediate cash. The factoring company handles collections, freeing you from waiting on customer payments.

With cash flow unlocked, you can invest in growth initiatives such as new technology, automation, equipment, or payroll. Accounts receivable financing for investing gives businesses flexibility to move forward without financial strain.

Why Accounts Receivable Financing Works for Technology Investments

Accounts receivable financing is well-suited for technology and automation investments because it converts earned revenue into usable capital without adding long-term debt.

Capital Scales With Sales and Receivables

As sales grow, receivables grow. Funding increases alongside business activity, making accounts receivable financing for investing a flexible option for expansion and operational efficiency.

No Long-Term Debt or Equity Dilution

Businesses invest using capital they have already earned. There are no multi-year loan commitments, equity dilution, or restrictive covenants.

Faster Access to Funding Than Traditional Loans

Because approval is based on receivables rather than lengthy credit reviews, funding is typically faster. This allows businesses to invest in technology when timing matters.

Cash Flow Aligned With Real Business Activity

Funding becomes available as invoices are issued and work is completed. This alignment supports consistent cash flow while investing in automation and modernization.

Click here to view or enlarge the graphic below.

Types of Technology and Automation Funded Through Receivables

Common investments funded through accounts receivable financing include accounting and A/R automation, ERP systems, CRM and sales automation platforms, manufacturing and logistics automation, and AI, data analytics, and workflow tools.

Accounts Receivable Financing vs Traditional Loans for Investing

Traditional loans often require extensive documentation, long approval timelines, and strong credit history. Startups may not qualify, while growing businesses may face delays or borrowing limits that do not keep pace with their growth.

Impact on Cash Flow and the Balance Sheet

Traditional loans add fixed monthly payments and increase balance sheet leverage, regardless of revenue timing. This can strain working capital.

Accounts receivable financing is tied to invoices, allowing businesses to access cash already earned. Funding grows with receivables and does not create the same long-term balance sheet burden.

Risk and Repayment Structure

Loan repayments remain fixed even if customers pay late or sales slow. This increases risk, especially for investments with gradual returns.

With accounts receivable financing, advances are repaid as invoices are collected. This structure reduces risk and aligns repayment with real business activity.

Why Receivables Financing Is Often a Better Fit for Operational Investments

Technology and automation deliver efficiency over time. Accounts receivable financing supports these investments by unlocking working capital without fixed repayment pressure, long-term debt, or reduced flexibility.

When Accounts Receivable Financing Makes Sense for Investing

Accounts receivable financing is a strong option for B2B companies waiting 30, 60, or 90 days on customer payments. It is also valuable for growing businesses that want to take on new clients, launch new services, or invest in technology but lack immediate cash.

By converting receivables into working capital, businesses can invest in automation, improve efficiency, and scale operations without taking on debt.

Turning Receivables Into a Growth Strategy

Receivables should be viewed as an asset, not a limitation. Accounts receivable financing for investing allows businesses to turn unpaid invoices into opportunities for growth.

RESOURCE CENTER

Learn More About Business

Invoice Factoring for Cleaning Companies | Get Paid Faster

How Invoice Factoring Helps Cleaning Companies You’re focused on keeping buildings spotless and clients happy, but when payments drag, payroll,…

What’s Affecting U.S. Manufacturing (Positive & Negative)

Why Your Manufacturing Business Needs Accounts Receivable Financing Discover what’s driving U.S. manufacturing challenges and growth, and why accounts receivable…

MERCHANT CASH ADVANCES – BEWARE!

Q: What should businesses know before taking a Merchant Cash Advance (MCA)? A: Merchant Cash Advances (MCAs) may offer fast…