When Banks Say “No,” We Say “Yes”

Applying for a business loan or business lines of credit can be time-consuming and frustrating, especially when it is denied. When a business needs cash, waiting for approval on a loan application may mean missed work opportunities or increased costs. This is why companies turned down by banks use accounts receivable financing with Scale Funding.

Accounts receivable financing, also known as invoice factoring, can provide companies immediate access to the cash they need, without the lengthy application process or waiting for approval. Throughout the United States, many companies facing bank turn-downs use factoring because of the fast account setup and quick access to cash.

Bank turn-downs of an application for a business loan or business lines of credit are exasperating and potentially fatal for a business. An accounts receivable factoring line is often much more easy and faster to obtain. Scale Funding can offer a quote for a factoring line in as little as 15 minutes.

How Factoring for Bank Turn-Downs Works

Accounts receivable factoring is a type of financing where a company receives a cash advance on their accounts receivables. Scale Funding will provide a competitive advance on the value of the receivables. The cash from factoring can be used by the client to meet any financial commitments they have. When Scale Funding receives payment on the receivables from the client’s customer, the remaining balance is remitted to the client less a small fee.

In addition to vital cash flow, Scale Funding provides value-added services including:

- Online reporting

- Customer credit analysis

- Accounts receivable management

- And More

The highly experienced Scale Funding staff help clients grow and succeed.

Factoring for Bank Turn-Downs in Any Industry

Scale Funding serves companies experiencing bank turn-downs. We ensure these companies have cash when it’s needed. For over 20 years, Scale Funding has served clients from many industries. Our industry knowledge and reputation for service have made us a leader in the factoring industry. Companies who want an experienced factoring company, with expertise in their work, choose Scale Funding.

Industry Knowledge and Experience

| Telecom & Wireless Companies Antenna Installation & Repair Tower & Outside Plant Construction Fiber Optic and Structured Cabling Installations Network Engineering Cell Tower Maintenance Plus many more | Heavy Construction Operations Concrete Contractors Construction Management Crane & Aerial Lift Operators Grading & Excavating Horizontal Directional Drilling Utility Locators And others |

| Technology Consultants Data Management IT Services Software Development Technology Solutions Providers And more | Utility & Pipeline Companies Pipeline Construction Right of Way Clearing Fabrication & Welding Trenching Services Underground Utilities Contractors Plus more |

| Oilfield Services Site Preparation Drilling Contractors Frac Sand Hauling Water Haulers Roustabout Services Well Servicing And others | Trucking & Freight Contract Carriers Freight Brokers Heavy Haulers Refrigerated Carriers Tanker Fleets And many more |

| Renewable Energy Engineering & Procurement Site Development services Construction Sub-contractors Operations & Maintenance And many more | Government Contractors Federal and State Provincial and Local Professional Services Pass-through Transactions And more |

| Staffing Agencies Administrative Clerical IT – Technology Light Industrial Medical And others | Other Industries Apparel Distribution & Wholesale Janitorial Manufacturing Printing Plus many more |

Factoring with Scale Funding

As a leading provider of factoring lines since 1994, Scale Funding is the right choice for companies dealing with bank turn-downs. If lack of available cash is holding back your business, talk to a Scale Funding representative today and find out how factoring can become part of your success.

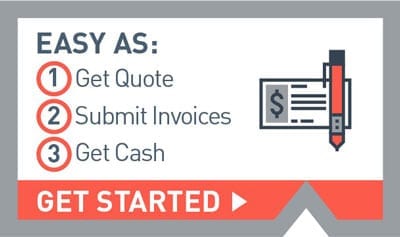

How Bank Turn-Downs Start Factoring

At Scale Funding, we know company leaders are focused on driving their business towards success. We understand that taking the attention away from the work at hand is counter-productive. We eliminate complications and offer a speedy setup process. With Scale Funding, getting set up for accounts receivable factoring is as easy as 1-2-3.

Step 1 – Get a Quote

The initial step in securing a factoring line is to speak with a Scale Funding representative. We’ll discuss your cash flow situation and needs, and we’ll offer a free, no-obligation consultation and quote for a factoring line. Our simple and straightforward underwriting guidelines allow most customers to receive written quotes in 30 minutes or less. All factoring quotes are customized for the specific needs of the client. We’ll work to make certain the factoring line meets your requirements.

Step 2 – Submit invoices and related documents

Once a factoring line is agreed upon, we’ll schedule your first funding. We can accommodate most schedules and offer an expedited service for those in need of immediate cash. During the set-up process, we’ll walk you through the agreement and discuss your invoices and any related materials.

Step 3 – Get cash for your invoices

When the set-up process is complete, we fund you via ACH direct deposit or a wire transfer directly into your bank account. From this point forward, each time we receive your invoices, we’ll process and fund you the same day the invoices are received.

Factoring with Scale Funding is a solution for Bank Turn-Downs. Call (866) 219-4873, or Contact Us today!

Get a quote that fits in 5 minutes flat!

We’re ready to help you get access to the cash you need. Contact one of our experts to find out how Scale Funding can help your business today.

COMMON QUESTIONS