The viability 5G or Fifth Generation Cellular Network is quickly moving from the laboratory into the field. Therefore, the Federal Communications Commission (FCC) is in the process of freeing up the high-frequency spectrum required to enable the technology. All four of the major national carriers (i.e. AT&T, Sprint, T-Mobile, and Verizon) are already in the process of defining and testing 5G technologies as part of their network buildout plans. But what are some of the challenges to deployment of 5G networks and how will this impact carrier business models?

Based on research, a laundry-list of issues come into view. While many of these issues are operational, others are related to the changing models financing network build out and finally the challenges related to emerging technologies and trends such as the Internet of Things (IoT) and the rise of smart cities.

While one might expect there is plenty of time to work out these challenges, the reality is quite different. AT&T and Verizon are already in the process of field testing 5G and the organizers of the 2018 Winter Olympics in South Korea and the 2020 Summer Olympics in Japan have announced their intention to deploy 5G networks in concert with the games.

In terms of mobile network build-out, 2018 might as well be tomorrow. The opening ceremony for the PyeongChang games is roughly 14 months away. For such a network to be in place all the standards need to be agreed to, frequency must be set aside, equipment must be designed, tested, built, and installed, and lastly the network itself must be tested before it goes live.

Standards

First of all, one of the challenges for 5G is coming to agreement on the standards for the technology. Given our proximity of the 2018 Winter Olympics, it is surprising how little headway has been made on this issue. At least to the point of agreeing on which standards will be used for field testing.

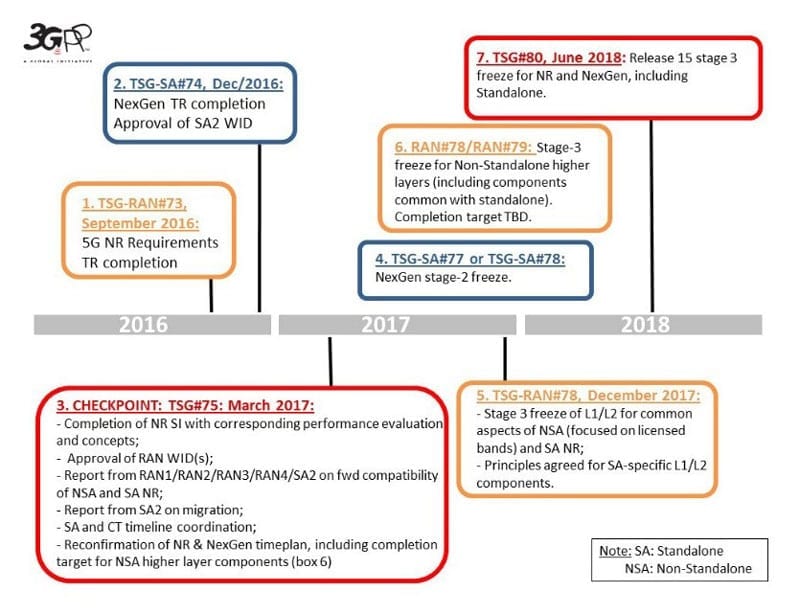

Original Plan for 5G Standards & Testing1

Only this past summer did the members of 3GPP (3rd Generation Partnership Project) agree on an ‘Accelerated Plan’ for fix wireless standards. This plan call for standards to be in place by no later than the end of 2017. In addition, field testing must start in the winter of 2018.

Original Plan for 5G Standards & Testing

While 3GPP covers several leading carriers and industry organizations, including ATIS (Alliance for Telecommunications Industry Solutions) in the U.S., the group is just part of a broader mix of organizations which help to coordinate technology standards around the world. Chinese-based equipment maker Huawei has been busy working with other equipment makers. The FCC has just recently approved spectrum frontiers plan which will help to set aside 11 GHZ of spectrum for 5G and related technologies.

Ok, so these announcements are great, but you are probably asking yourself how this will impact carrier business models? The biggest change will be the ability to offer a broader array of value-added services. However, standards need to be in place before carriers can even think about how they can monetize this new technology. The current level of uncertainty means that carriers are stuck in a wait and see mode.

CAPEX to OPEX Conversion

Cost

Building a cellular network is expensive. According to sources, the cost of Sprint’s recent network upgrade will cost between $3 billion and $5 billion. Granted, part of this expense is the cost of retiring debt from previous network rollouts and the acquisition of Nextel. However, much of the funds will be used to improve the performance of the much-maligned network.

The cost helps to explain why carriers are large companies – even in small markets. However, the model of building and operating your own network is largely going the way of the dodo. Reasons for this shift include cost, growing bandwidth requirements and the rate of technological change.

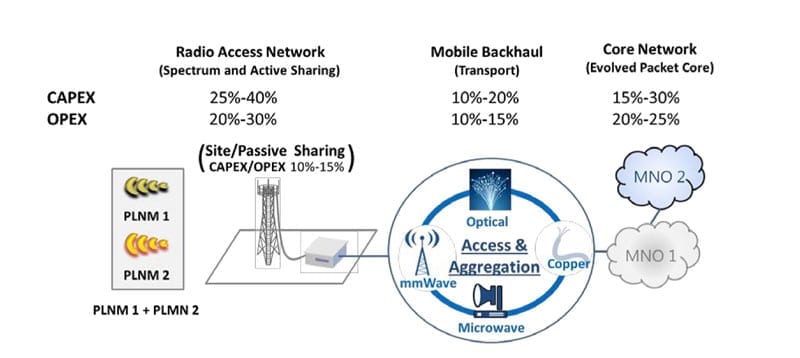

In terms of cost, Sprint has already implemented site leasing. This is a rather old-school solution to network build out where the carrier leases a cell site from the site owner. However, the next step in CAPEX to OPEX (Capital Expenditure to Operational Expenditure) Conversion is multitenancy through network broker slicing. The concept was explored in a paper from researchers at NEC Labs in Germany. They defined network broker slicing as “enabling mobile virtual network operators (MVNO), over-the-top providers, and industry vertical market players to request and lease resources from infrastructure providers dynamically via signaling means.”2

Network Broker Slicing

In simple terms, network broker slicing allows carriers to act as MVNOs by leasing capacity from other carriers or even from non-carrier infrastructure providers. This not only opens new opportunities for wholesaling frequency but it also helps carriers to maximize network usage. According to a report published by researchers at Coleago Consulting, the traffic carried by nearly half of all radio access sites surveyed account for less than 10 percent of carrier revenue. Granted, some of this is due to need to offer rural coverage, but the rise of micro-sites is also another reason why revenues are increasingly concentrated on a minority of sites.

Therefore network planners are increasingly looking at new models to offset the passive investment of cell networks by shifting to a more dynamic model. While the NEC study focused on European carriers, the findings showed CAPEX to OPEX Conversion can concurrently reduce network infrastructure cost by half and cut network operational costs by up to 20 percent has gotten the attention of network planners and CFOs throughout the industry.

Overview of Capex/Opex Conversion Model3

Security

Emerging technologies such as IOT, autonomous vehicles, smart cities, and micropayments all rely on 5G networks. Without a robust backbone, the system will grind to a halt. However, one nagging challenge is how to secure devices and networks to make sure they are not prone to attack. Let’s face it, a connected world of 20 billion or more IoT devices is a prime target for cybercriminals.

In November 2016, the National Institute of Standards and Technology (NIST) announced guidance on system security for IoT systems. The security standards take a bottom-up approach to cyber security for IoT. The 257-page document includes guidance on best practices for System Security Engineering including the Infrastructure Management Process. While a large part of IoT security is based on the devices themselves, the role of mobile networks cannot be understated. Whilst the specific of these concepts are best left to engineers, the best practices outlined by NIST will impact network design and security for carriers and customers.

In fact, the emphasis is to shift from the ‘bolt-on’ security approach towards building devices and networks which are embedded with a series of passive and active security measures. According to sources one of the main drivers for the documents release was the recent Mirai malware attack which preyed on IoT devices to attack vulnerabilities within the infrastructure of internet infrastructure company Dyn.

Smart Cities

Many ‘Smart City’ applications are already viable without 5G. However, there is no doubting that the capabilities of 5G will unlock the full promise of smart cities. According to estimates from the United Nations, more than 66 percent of the world’s population will live in urban areas by 2050. Because of the increased migration, it will put stresses on many of the systems which we take for granted today. These include roadways, water and sewage networks, education, and healthcare systems to name a few.

One way to maximize existing infrastructure while improving access to, and the level of services, is to implement the cornucopia of services which make up a smart city ecosystem. Whilst IoT-enabled devices are a key part of smart cities so are the networks which will provide the backbone. For carriers, this means entirely new opportunities for over-the-top services.

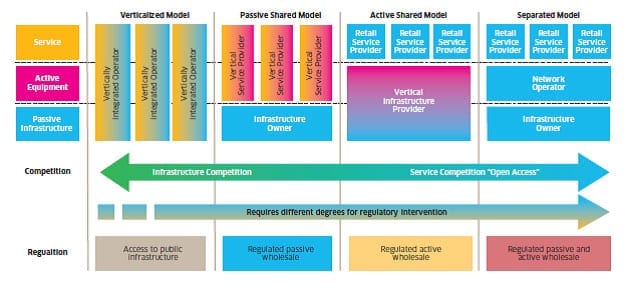

In fact, Alcatel-Lucent recently conducted a study on smart cities and one of the findings were the revenue capture opportunities which included could be found by optimizing offerings of passive and active infrastructure as well as services. Seems like in a world where mobile service has become a commodity, this is music to the ears of many carriers.

Potential Smart City Business Models4

One of the revenue capture services highlighted by the study included IP bitstream access which will be vital for device-to-device (D2D) communications. As a result, add-ons like this have the potential to solidify ARPUs for carriers while shifting their business models aware from more consumer applications and towards industrial applications.

Sources:

13GPP. 3GPP on track to 5G. 27 July 2016. https://goo.gl/ACxU7Z. Retrieved 30 November 2016.

2 Samdanis, K; Costa-Perez, X; Sciancalepor, V. NEC Europe Ltd. From Network Sharing to Multi-tenancy: The 5G Network Slice Broker. Not Date. https://goo.gl/kfLCz9. Retrieved 30 November 2016.

3Samdanis, K; Costa-Perez, X; Sciancalepor, V. NEC Europe Ltd. From Network Sharing to Multi-tenancy: The 5G Network Slice Broker. Not Date. https://goo.gl/kfLCz9. Retrieved 30 November 2016.

4Alcatel-Lucent. Getting Smart About Smart Cities: Recommendations for Smart City Stakeholders. 2012. https://goo.gl/uMnMRn. Retrieved 30 November 2016.

RESOURCE CENTER

Learn More About Telecom

How to Fund Telecom Expansion Without Taking Out a Loan

The telecom business is evolving rapidly, driven by the demand for high-speed internet, fiber rollouts, and better connectivity in rural…

Net-60 Payment Terms? How Telecom Companies Get Paid Fast

For many telecom companies operating under B2B telecom contracts, long payment terms like net-60 are standard. These delayed payment cycles,…

A Guide to Invoice Factoring: A Solution for Business Cash Flow Challenges

In today’s fast-paced and competitive market, businesses often face cash flow problems. These issues can slow growth or even threaten…