You’re not alone if you find yourself waiting for customers to settle their outstanding invoices. Many business owners face this challenge. Invoice factoring could be the solution you need.

Accounts receivable typically have payment terms ranging from 30 to 90 days. After sending an invoice to a client, collecting payment may take a month or longer. This delay can cause cash flow issues for small to mid-sized businesses, making covering expenses like employee payroll, bills, and supplies challenging. As a result, the cash shortage can hinder your ability to invest in growth opportunities or maintain daily operations.

This guide will clarify all aspects of invoice factoring, helping you decide whether it suits your business.

What is Invoice Factoring?

Invoice factoring is when you sell your unpaid invoices to a factoring company in exchange for instant cash. Since it’s a sale and not a bank loan, it doesn’t affect your credit score like traditional bank financing would. Factoring, or accounts receivable financing, helps small businesses get cash from their invoices before customers pay.

What is an Invoice Factoring Company?

A factoring company, or “factor,” is a financial partner that buys your invoices in exchange for cash. After approval, you can sell your unpaid invoices to get cash quickly and avoid waiting for extended payment terms, thus improving your cash flow.

Selling your invoices to a factor provides you with immediate funds, allowing you to access the money owed to you without waiting for the customer to pay. The factoring company reviews your invoices and advances you up to 90% of the total amount. They then follow up with your customers for payment. Once the customer pays the invoice, the factoring company pays you the remaining balance minus a fee.

Example Scenario

• Invoice Face Value: $100,000

• Factoring Fee (e.g., 2%): $2,000

• Initial Cash Advance (e.g., 90%): $90,000

• Remaining Advance: $8,000

• Total Amount Received: $98,000

How Invoice Factoring Works

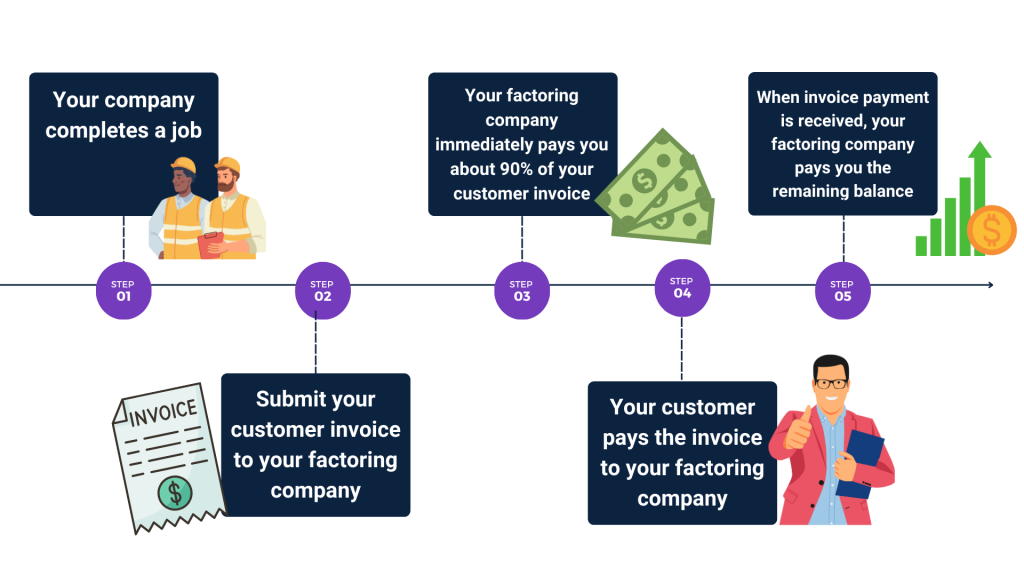

Factoring is a relatively simple and direct form of financing. By understanding how it works, you can decide if it’s a suitable option for your company.

1. Service/Delivery: Your business offers a service or product and sends an invoice to the client.

2. Invoice Submission: You submit the invoice to the factoring company.

3. Initial Advance: The factoring company advances you approximately 90% of the invoice amount.

4. Customer Payment: Your customer pays the invoice to the factoring company.

5. Final Payment: The factoring company pays you the remaining balance minus a fee.

Invoice Factoring Process Step-by-Step

Do I Qualify for Invoice Factoring?

To qualify for invoice factoring, a business must have the following:

- Present invoices that can be factored

- Creditworthy clients

- A finalized factoring application form

- An accounts receivable aging report

- A commercial banking account

- A tax identification number

- Personal identification

Common Misconceptions with Invoice Factoring

You may have heard some negative things about invoice factoring. Here are a few common misunderstandings:

- It’s only beneficial for struggling businesses: Factoring can be a great cash flow solution for businesses of all sizes and stages of growth. Many large companies use factoring to reduce debt.

- It is too expensive to be sustainable: While factoring is generally more expensive than traditional loans, businesses that are a good fit for factoring can gradually increase prices to compensate for factoring costs.

- You can’t use factoring if you have bad credit: Factoring companies are primarily concerned about the creditworthiness of your customers, not your business.

- You can’t use factoring if you have bad credit: Factoring companies are primarily concerned about the creditworthiness of your customers, not your business.

Independent Factoring Companies vs. Bank Factoring Companies

Independent Factoring Company

Stand-alone factoring companies work with businesses that need to accelerate cash flow and may have been turned down by banks. They must borrow from a third party to fund your invoices, which can increase risk and costs for your business. They are not FDIC-insured and not as heavily regulated, which can lead to predatory practices.

Bank Factoring Company

A bank factor provides the same flexibility and benefits as an independent factor but with additional advantages:

- Easier transition to bank loan: Businesses that work with a bank-owned factoring company may find it easier to transition to a commercial loan.

- Greater security: Banks offer financial stability and comfort not found in independent financing companies.

- Competitive rates: Banks can offer competitive rates as they use their own funds, eliminating the go-between.

Why Scale Funding?

At Scale Funding, we go beyond just addressing our clients’ accounts receivable financing needs. We are committed to being responsive, attentive, and proactive. Our goal is for our clients to have complete confidence in our integrity, dedication to excellent service, and commitment to their success.

With a track record of serving numerous businesses across the United States and the support of a bank, we have extensive experience in the unique challenges faced by small to mid-sized companies.

RESOURCE CENTER

Learn More About Invoice Factoring

How Much Does Invoice Factoring Cost? Breaking Down Fees & Rates

Invoice factoring is a fast, flexible way for businesses to unlock working capital tied up in unpaid invoices. For industries…

Using Receivables to Invest in Technology and Automation Without Taking on Debt

Running a business is challenging. As a business owner, you have employees, customers, and partners depending on you. Keeping up…

Invoice Factoring for Cleaning Companies | Get Paid Faster

How Invoice Factoring Helps Cleaning Companies You’re focused on keeping buildings spotless and clients happy, but when payments drag, payroll,…