Invoice Factoring Versus an MCA Loan

When a business needs a quick infusion of cash, there are two primary options: invoice factoring or a merchant cash advance (MCA) loan. While both options provide money, there are fundamental differences between factoring and an MCA loan. Understanding the basics of each helps determine which is the right one to use.

What is Invoice Factoring?

Invoice factoring is simply selling unpaid invoices to a factoring company for a cash advance, it is not a loan. The factoring company immediately advances between 80% – 95% of the value of the invoice. Once the client’s customer pays the invoice to the factoring company, the remaining balance is remitted to the customer, minus a factoring fee.

Companies that provide business-to-business services with Net30 or longer payment terms use factoring to ensure consistent cash flow. When a company factors its invoices on a daily or weekly schedule, it receives regular cash advances to use towards business payables, daily expenses, or new opportunities.

What is a Merchant Cash Advance (MCA) Loan?

An MCA loan is a short-term, lump-sum loan for businesses. A company can be approved quickly for an MCA, and the loan proceeds used for any purpose. Companies that transact sales or take payments via credit card are the primary users of MCA loans, but MCA loans have spread across many industries.

An MCA loan is repaid through automated deductions from the business bank account, usually daily or weekly. These regular deductions require the business to monitor its account balance closely to avoid defaulting or having a negative balance.

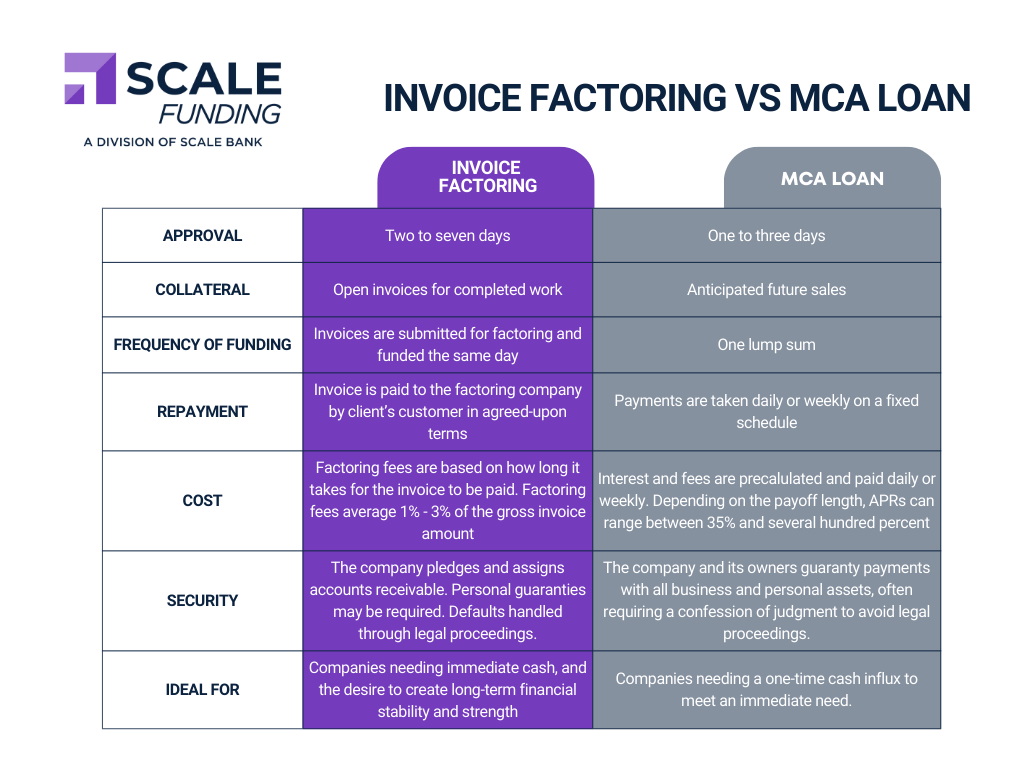

Invoice Factoring or an MCA – How Do They Compare?

When a business needs cash quickly, the choice between factoring and an MCA loan comes down to what’s right for the business and its owners. Here are some comparisons.

Choose the Right Financing for the Business Situation

Invoice factoring and an MCA loan both provide cash to businesses very quickly. MCA loans are a good choice for companies with certain future sales needing a one-time cash flux. Invoice factoring provides the initial cash needed based on completed work and is a longer-term source of money to build a financially strong company.

RESOURCE CENTER

Learn More About Uncategorized

Webinar – If I Knew Then What I Know Now: Real Talk from Staffing Agency Owners

The path to building a successful staffing agency is filled with lessons and some learned the hard way. In this…

How to Choose the Right Factoring Company: 5 Key Considerations

Choosing the right factoring company is hard to do when other companies claim to offer the best invoice factoring solutions.…

Feeling Safer with SAFER

It is more important than ever to really be aware of who you are working with. Scale Funding provides you…