In today’s fast-paced and competitive market, businesses often face cash flow problems. These issues can slow growth or even threaten operations. Invoice factoring has emerged as an efficient solution for fostering growth, overcoming financial strain, and ensuring consistent cash flow. This article looks at the different aspects of invoice factoring. It also includes essential topics for various industries and business situations.

What is Invoice Factoring, and How Does It Work?

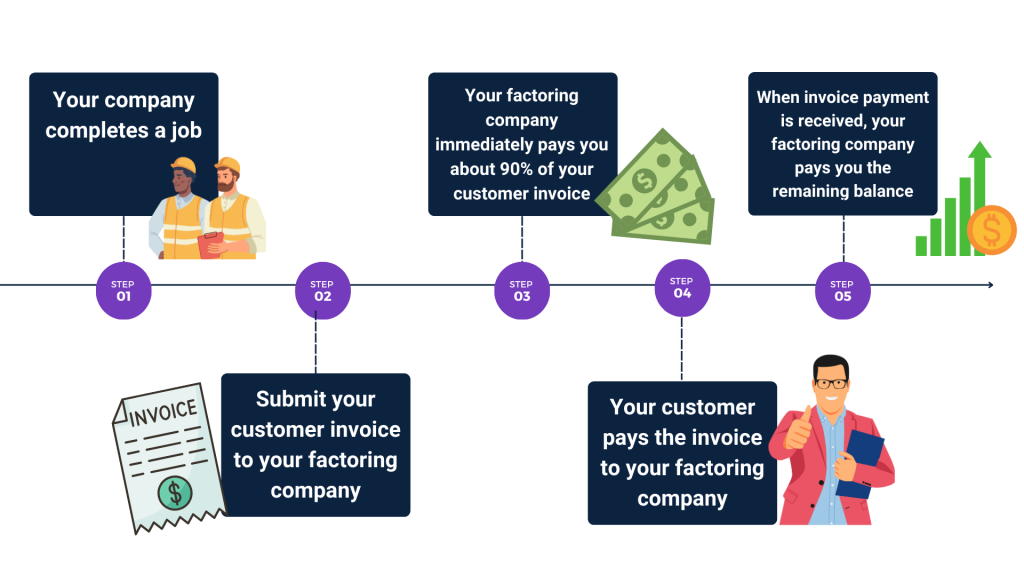

Invoice factoring, or accounts receivable financing, is a financial solution where businesses sell their unpaid invoices to a third party (factor) in exchange for immediate cash. This process eliminates the waiting period for customer payments, allowing businesses to maintain steady cash flow. It’s particularly beneficial for companies with extended payment terms, typically 30 to 90 days.

The factoring company advances a percentage of the invoice’s value upfront, usually around 80-90%, and releases the remainder (minus fees) once the invoice is paid. This funding model bypasses the debt and equity issues related to traditional financing, making it a preferred financial solution for many.

Why Businesses Are Choosing Invoice Factoring

- Financial Solution for Businesses Without Bank Loans or Credit Lines: Provides immediate funding for businesses unable to secure traditional financing, offering a debt-free way to sustain operations and growth.

- Improved Cash Flow: Converts unpaid invoices into liquid funds, helping businesses cover operating expenses, payroll, inventory, and sales efforts while avoiding cash flow gaps from delayed customer payments.

- Fast Funding for Growth: Offers quick access to capital with minimal paperwork and flexible terms, enabling businesses to seize expansion opportunities like hiring, launching new products, or entering new markets.

Invoice Factoring for Specific Industries

Industries with extended payment cycles and high working capital requirements often find this financial strategy more suitable. Let’s explore how invoice factoring benefits key sectors:

- Construction Companies

Construction businesses often face high upfront costs for labor and materials while waiting for customer payments. Factoring bridges the gap between project completion and receivable collections, ensuring uninterrupted operations. - Cash flow for the Transportation and Logistics Industry

Freight factoring for trucking companies ensures that truckers and fleet owners can access steady cash flow, crucial for covering fuel, maintenance, and payroll needs amid ongoing deliveries. - Financing for Staffing Agencies

Staffing agencies that pay employees weekly but receive client payments after 30-60 days benefit from factoring to sustain payroll without stress. - Factoring for Manufacturing Businesses

Manufacturers face heavy overhead costs for raw materials and production. Factoring offers immediate liquidity to fund operations and bulk orders efficiently. - Invoice Factoring for Wholesale and Distribution Companies

Distributors often face delayed payments, especially during peak seasons. Factoring ensures they maintain inventory and meet operational costs seamlessly. - Invoice Factoring for Startups and Growing Companies

Startups and businesses in the growth phase often lack access to credit or capital. Factoring provides a cash injection without taking on debt, making it a viable solution. - Alternative Financing for Small Businesses: Invoice Factoring

For small businesses unable to secure traditional funding, factoring serves as an accessible and flexible financing option.

Selecting the Right Factoring Partner

How to Choose the Right Invoice Factoring Provider

Choosing a factoring provider involves considering multiple factors:

- Experience and Reputation: Look for companies with expertise in your industry.

- Funding Speed: Ensure the provider can deliver funds promptly.

- Fee Structure: Compare costs among providers to determine the most cost-effective option.

- Transparency: Opt for providers that are upfront about hidden costs.

- Customer Service: A reliable partner should offer excellent customer support and communication.

Best Invoice Factoring Companies for Small Businesses Researching and identifying the best factoring companies tailored to your business size and needs will ensure a seamless and profitable experience.

Leveraging Invoice Factoring for Business Success

Invoice factoring isn’t just a financing tool; it’s a strategic advantage that lets businesses focus on growth rather than worrying about delayed payments. Whether you are a trucking company, a construction firm, or a startup, factoring can be customized for your unique needs.

Exploring invoice factoring solutions for managing business cash flow will reveal how this financial model can act as an effective lifeline. From providing liquidity to seasonal businesses to facilitating expansion for growing companies, factoring transforms operational challenges into opportunities for success.

For those in niche industries like freight factoring for trucking companies or invoice factoring for wholesale and distribution companies, tailored solutions ensure that business-specific challenges are addressed.

Invoice factoring is more than just a remedy for delayed payments—it’s a proactive approach to optimally manage cash flow and fuel growth. By understanding its benefits and choosing the right provider, businesses can unlock their full potential.

RESOURCE CENTER

Learn More About Business

Staffing Industry Trends – February 2026

Insights on trends, market dynamics, and industry innovations

How Much Does Invoice Factoring Cost? Breaking Down Fees & Rates

Invoice factoring is a fast, flexible way for businesses to unlock working capital tied up in unpaid invoices. For industries…

How Staffing Firms Win More Business in a Tough Hiring Market

According to the Entrepreneur Magazine article “Job-Seekers Find the Market Challenging to Break Through – And It’s Due to One…