Invoice Factoring

Factoring Helps Add Key Employees

Businesses in all industries rely on well-trained, experienced workers to serve their customers. Hiring good people, or training someone who…

How to Choose the Best Invoice Factoring Company

If you do an online search for factoring companies, you’ll quickly realize there are thousands of results. How do you…

Invoice Factoring and More

Invoice factoring is an easy way to maintain your cash flow and ensure your company stays successful. In addition to…

Collections and Client Relationships

One of the value-added benefits of factoring with Scale Funding is the work done by the AR Management Department. The…

Is Accounts Receivable Factoring Right for You?

Accounts receivable factoring is a debt-free financing solution that allows companies to unlock working capital that is normally tied…

How Invoice Factoring Improves Cash Flow

Invoice factoring improves cash flow by enabling companies to immediately access the cash that is tied up in their open…

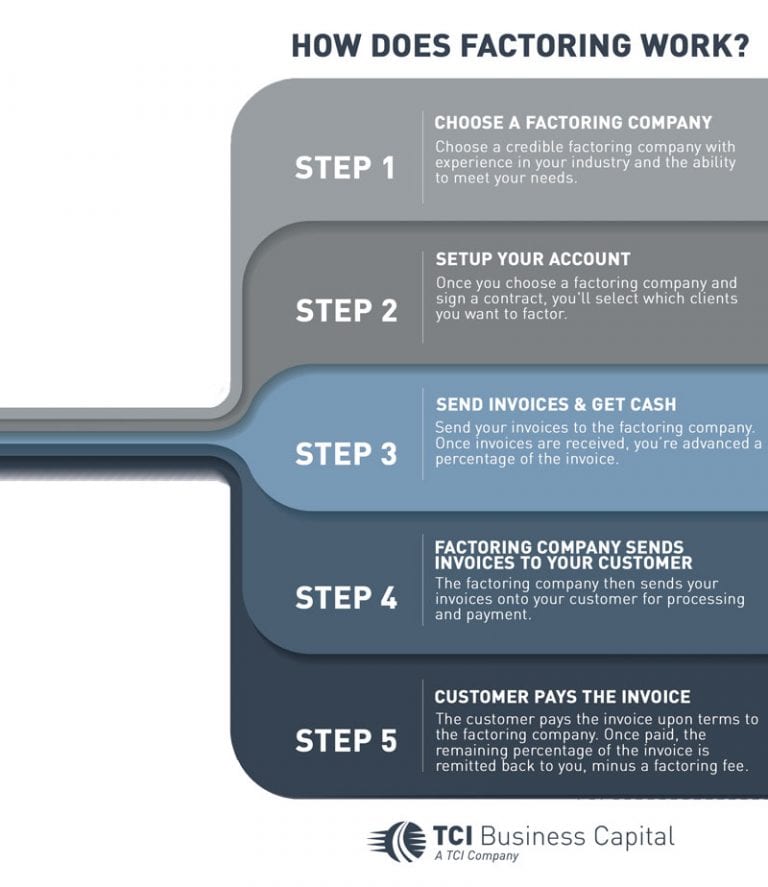

How Does Factoring Work?

Invoice factoring, also known as accounts receivable factoring, is a debt-free financing solution used by companies to take control of…

How Factoring Improves Invoicing

How Factoring Improves Invoicing – Best Tips and Practices It surprises people to learn how factoring improves invoicing. Here at…

How Much does Factoring Cost?

Accounts receivable factoring is a great way to provide your company with the capital flow that it needs to run…